The World of Loan Raptor: Revolutionizing Financial Services

Are you in search of a financial service that caters to your unique needs, regardless of your credit score? Loan Raptor is here to offer a lifeline in the world of personal finance, and this article will delve into its journey, services, and commitment to users.

The Birth of Loan Raptor

Loan Raptor emerged at a time when obtaining a loan often felt like navigating a labyrinth. The founding story of Loan Raptor begins with a group of visionary entrepreneurs who recognized the need for a more accessible, hassle-free, and inclusive approach to personal finance. The historical context of financial rigidity and bureaucracy served as the backdrop against which Loan Raptor emerged, aiming to disrupt the industry's status quo.

What sets Loan Raptor apart is its unwavering commitment to inclusivity. The founders identified a niche market that encompassed a wide spectrum of individuals, regardless of their credit backgrounds. This brand was founded with the belief that financial assistance should not be reserved for a select few. Loan Raptor's vision was clear: to provide a lifeline for those with good credit and those struggling with bad credit, offering financial solutions that cater to the unique needs of each individual.

Loan Raptor's core values revolve around inclusivity, transparency, and adaptability. Their vision transcends traditional boundaries, aiming to provide a level playing field for all consumers. Transparency is the bedrock of their services, ensuring that you know exactly what you're getting into when applying for a loan. Their adaptability means that they offer financial solutions that range from $500 to $50,000, breaking down barriers that have deterred many from seeking financial assistance.

Specialized Financial Services

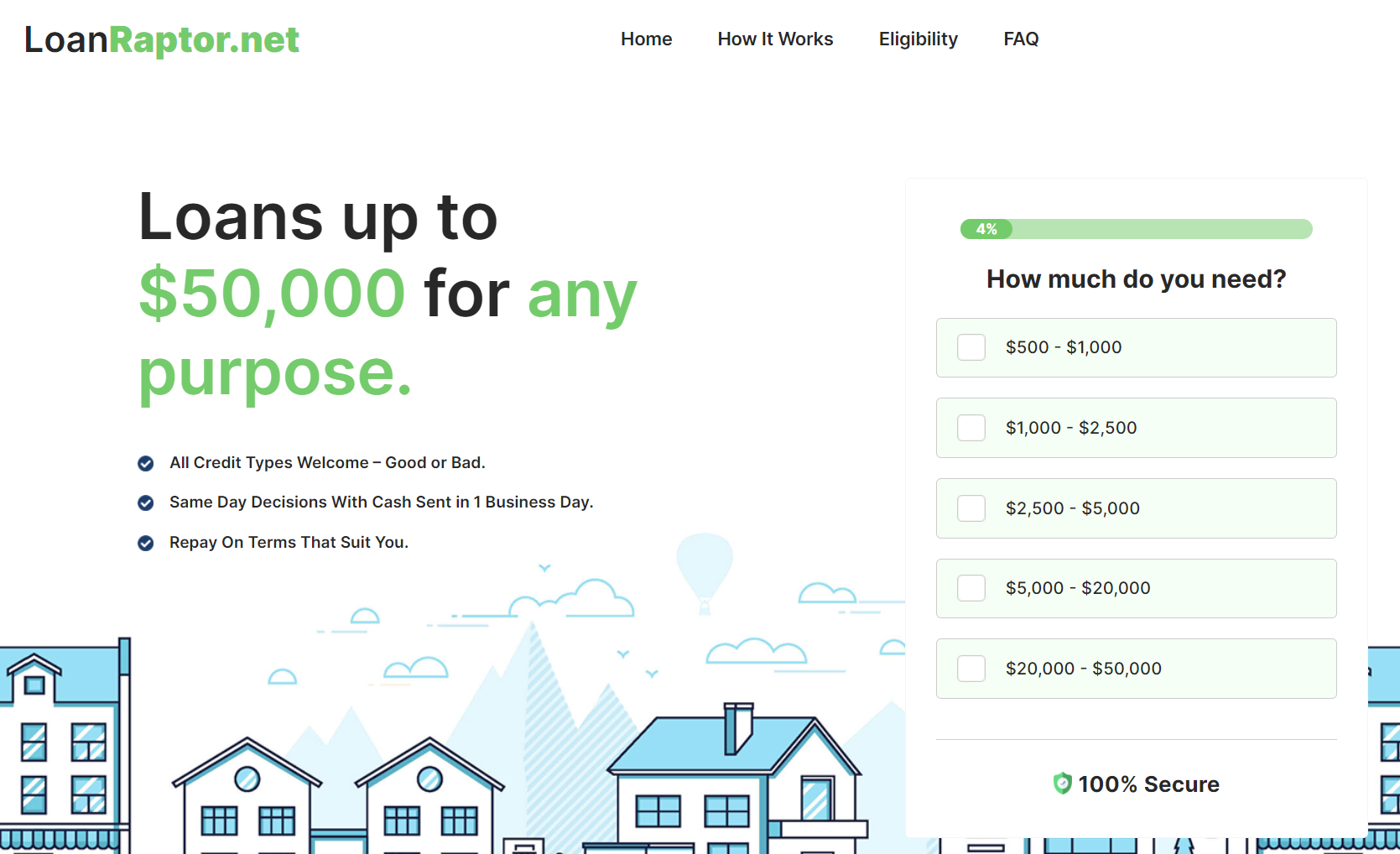

Loan Raptor offers a wide range of loan options, starting from $500 and going all the way up to $50,000. Their financial services cater to a variety of needs, from covering unexpected expenses to larger investments. With flexible loan amounts and repayment terms tailored to individual circumstances, Loan Raptor addresses the diverse financial needs of its customers.

The uniqueness of Loan Raptor's services lies in their adaptability. They understand that financial needs vary from person to person. Whether you require a small loan to bridge a financial gap or a substantial sum to make an investment, Loan Raptor's services are designed to accommodate your specific requirements.

Tech-Driven Financial Solutions

Loan Raptor's commitment to innovation is evident in the technological solutions it employs to simplify the loan application process. Their user-friendly interface and streamlined online platform ensure a quick and efficient response to loan applications. By leveraging cutting-edge technology, Loan Raptor minimizes the complexities and frustrations that often accompany the lending process, making it accessible to a wider audience.

Loan Raptor goes the extra mile to ensure that the user experience is exceptional. From the moment you land on their website, you'll notice their dedication to simplicity and clarity. The application process is designed to be intuitive and efficient, saving you time and effort.

Navigating Loan Raptor's platform is a breeze. Their user-friendly interface allows you to easily input your information, select your loan amount, and set your preferred repayment terms. This level of customization empowers users to make financial decisions that align with their unique circumstances.

Loan Raptor doesn't just talk the talk; it also listens to its users. They actively seek and value feedback from their customers, using it as a compass to guide their continuous improvement efforts. This feedback loop ensures that Loan Raptor's services evolve to meet the ever-changing needs of their customers.

Regulatory Compliance and Data Security

Loan Raptor places a premium on regulatory compliance, and its operations adhere to all relevant financial regulations. This commitment to compliance not only ensures a safe and secure environment but also instills trust in users.

Data security is paramount in the digital age. Loan Raptor prioritizes the privacy and protection of your personal and financial data through state-of-the-art data encryption and stringent privacy measures. This focus on security offers peace of mind to users, knowing that their sensitive information is in safe hands.

Loan Raptor understands that trust is at the heart of any financial service. By providing a secure environment where users' data is handled with the utmost care, they not only comply with regulations but also build a lasting trust with their customers.

Loan Raptor, with its unique vision, adaptable services, tech-driven solutions, user-centric design, commitment to security and privacy, and strategic partnerships, is changing the way people access financial assistance. Regardless of your credit status, Loan Raptor is on a mission to provide quick and reliable solutions.

FAQ

What types of loans does Loan Raptor offer?

Loan Raptor provides personal loans that cater to various financial needs. These loans can be used for a wide range of purposes, from covering unexpected expenses to larger investments.

What is the application process like?

The application process at Loan Raptor is straightforward and user-friendly. You can access their platform online, enter your information, select your loan amount, and customize your repayment terms to fit your circumstances.

Can I get a loan with a low credit score?

Yes, Loan Raptor accommodates individuals with bad credit. They have designed their services to be inclusive, ensuring that credit history is not a major barrier to accessing a loan.

How quickly will I receive the loan funds?

Typically, once your installment loan is approved, the funds will be transferred electronically into your bank account via electronic transfer within the next business day.